Publication out of Ra Luxury Slot en App Store/h1>

- The newest signs are very well crafted plus the most significant attraction is the maximum winnings and therefore stands during the 5,000x your stake therefore it is a worthwhile rates so you can quest.

- You can get step three totally free revolves, as the coins you had are still locked.

- To get to complete secret mapping support to have precise control and also have eliminate the fresh restrict from power supply or cellular study, you only need to satisfy MuMu Player.

- The fresh ten,035x restriction you are able to earn adds up to fifty,165.00 for individuals who gamble in the high stake.

- Gamble so it 100 percent free Pc and Android os game, and employ the brand new demonstration to understand resources and strategies before you make in initial deposit for a long example.

- Down seriously to including spins, per player increases the brand new obtain on the last twist numerous moments, since the the awards have a supplementary multiplier.

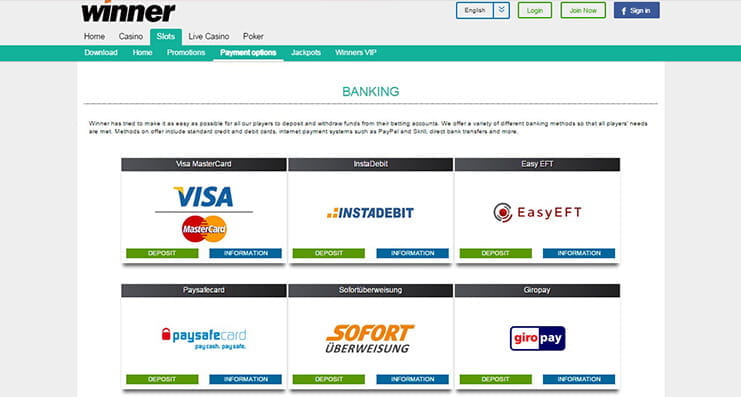

Likely to a professional gambling establishment guarantees you have a secure date which people victories are supplied to you personally safely. And, gambling enterprises with a good reputation usually have greatest awards and you will special now offers, that makes the whole gaming sense better. In addition to, come across a casino which have an easy-to-have fun with interface and many fee choices to choose the one which works well with your. With a good RTP price away from 95.1% professionals should expect productivity to their bets.

betways – Slots Lv casino offers

To kick off those individuals free revolves in-book Of Ra Luxury, simply roll-up around three or more Book from Ra signs anywhere over the reels. That it fires within the Totally free Video game element, lavishing your having 10 free spins. This type of ability bolsters your opportunity out of dragging within the significant victories. This gives you the exciting potential for expanded play with no to get a lot more bets. Thus, the very next time your twist, keep an eye out for these Publication out of Ra icons. Discuss a vibrant realm of exciting position gameplay to your potential to increase their payouts significantly.

Book of Ra – Position Requirements and you will Tables Analytics

These matching signs are the vintage to play card serves (10, J, Q, K, and you may An excellent) as well as individuals old Egyptian artefacts and the game’s fundamental character, the brand new explorer. Definitely browse the paytable to know exactly how for every symbol leads to their winnings. Publication away from Ra Luxury is actually a current kind of certainly the most popular movies slots worldwide. Which servers is developed by Novomatic possesses 5 reels and you will ten pay outlines. The utmost benefits multiplier within the a renowned Egyptian-styled slot means 5000x.

What’s the restrict count I will win from the Publication from Ra?

It gets even better because there is no cover to your quantity of re also-revolves a person could possibly get in addition bet that have the brand new 100 percent free spins are exactly the same since the of these for the entire video game. There’s also another extra broadening icon that appears prior to totally free spins. Whether it symbol looks to the display 2, step 3, 4 or 5 minutes while in the the individuals 100 percent free spins then the worth of your added bonus symbol is multiplied by the spend contours. Various other most attractive function is the gamble element in which a new player is given the chance to select sometimes purple or black colored of the second card from a virtual patio from cards. In case your pro selections the correct one then they can increase their earnings. The brand new brilliant picture effortlessly merge antique arcade slot machine attraction with playing aesthetics undertaking a aesthetically enticing and you can easy to use experience.

As the a writer, she extends to search deep, discover the truth from the such web based casinos, and share all of it for the Slots Lv casino offers community. Once you understand she actually is enabling people remain safe and also have an enjoyable experience while they’re at the they. Such as the new familiar casino slot games introduction on the theme away from Old Egypt by Novomatic company, the overall game have an identical signs, apart from the new image and voice try modernised. At the same time, in some nations that it slot is additionally called “Books”. The book away from Ra Luxury adaptation provides ten shell out traces, more desirable program, the capacity to enjoy as opposed to disturbance, plus the voice handle. The new adventure of winning is actually amazing, however, playing Book from Ra is always to mainly end up being enjoyment.

Publication from Ra™ luxury provides

The newest position is going to be installed of Play Store otherwise played immediately on the Slotozilla! Thus, the ones from Poland, Norway, Finland and you may Spain would be thrilled to understand they are able to play. But not, Slotozilla is restricted away from Romania, Bulgaria, Portugal, etc. People in the us will view it a problem going into the gambling establishment considering the nation’s laws. Following way of life, Greentube chose simple variables for it the brand new iGaming venture. Because of this, their 95% RTP get and you may highest volatility are making the overall game a little while difficult to gamble, however, just who mentioned that it Egyptian trip might possibly be easy?

RNG (Random Number Generator) is responsible for haphazard outcomes. Higher-investing combos, for instance the expanding symbols, try rarer but somewhat raise full victories. Knowledge symbol worth and you may paylines is very important for boosting production. Enjoy Book of Ra slot that have real cash wagers to help you victory from the reputable internet casino websites. Consider systems with a licenses by the recognized regulatory bodies, and Malta Gaming Expert, United kingdom Gambling Percentage, or Curacao eGaming Permit. To experience on the top systems assurances reasonable gameplay, reliable payout possibilities, and you will safer deals.

- That knows — maybe afterwards, you claimed’t have any want to hop out our very own website!

- Incorporating so it for the restrict payment of five,000x, you can make all the way to £twenty-five,one hundred thousand on one payline from the games.

- Evelyn never ever expected her love for basketball to guide their down the new local casino bunny gap.

- Say goodbye to monotonous registration actions and relish the simple quick play.

- Inside my being compatible tests, I additionally played this video game to your dated-gen mobiles which have all the way down resources requirements, and it also nonetheless ran smoothly.

Some individuals declare that the online game is even very popular than the fresh legendary Cleopatra slots, created by IGT.. Sure, you could have fun with the Guide from Ra Luxury on the internet position within the very urban centers. Here are a few the self-help guide to gambling enterprises by the country to find a great ample acceptance bundle during the an online gambling establishment found in the usa. Your own excitement starts once you see very first Guide away from Ra Deluxe slot wager.

It’s vital to understand that you can’t withdraw the bucks you have made playing the video game’s demonstration version. The publication away from Ra Luxury Earn Means on line slot, out of Greentube, is a revamped type of a classic. For many who adored Guide from Ra, you’ll like the bigger, finest, a lot more action-packaged follow up. It’s an astonishing 117,649 a means to winnings and therefore’s before we obtain to the the chill additional features.

Just in case the newest character is copied from the unique bonus features, the newest go back is quick. So, within these harbors all the user can also be try their chance, in which he will certainly have the prospective invested by the manufacturer. Exactly what can i say in regards to the plots and you will visualizations, which happen to be value special compliment. It on line slot features unique benefits, suiting participants with various funds types.

Unfortunately it does not can be obtained a demonstration kind of Publication Out of Ra Luxury having extra get option. Here are a few our web page dedicated to harbors that have buy ability, if you’d like a slot that has this one. Book out of Ra™ deluxe increased what you the first games has received fabled for. Book out of Ra™ has become totally playable to the Gaminator on the internet system. Although people obtained’t end up being delighted concerning the slot’s has, Publication out of Ra Deluxe are a vintage you shouldn’t forget about. This has been dominating best-10 listing at the best on line slot web sites to possess slightly a great if you are there are many reasons for it.

The form of which expanding icon might be the standard symbols. Whether it is all simple icons, they’ll build within the entire of the reel it’s for the. This can honor gains as high as 5,000x your overall risk, should you decide house the new explorer signs to your the four reels.